what is the salt deduction repeal

The Congressional Budget Office said on Thursday that over the course of a decade the changes to the deduction would amount to a tax increase that would raise about 148. Tom Suozzi writes For 100 years Americans relied on this deduction Letters Aug.

The Push To Repeal The Salt Cap The Long Island Advance

The taxes eligible for the SALT deduction are certain real property taxes income taxes sales taxes in lieu of income taxes and personal property taxes.

. The TCJA also repealed the Pease limitation for tax. Second the 2017 law capped the SALT deduction at 10000 5000 if youre. Under TCJA the SALT.

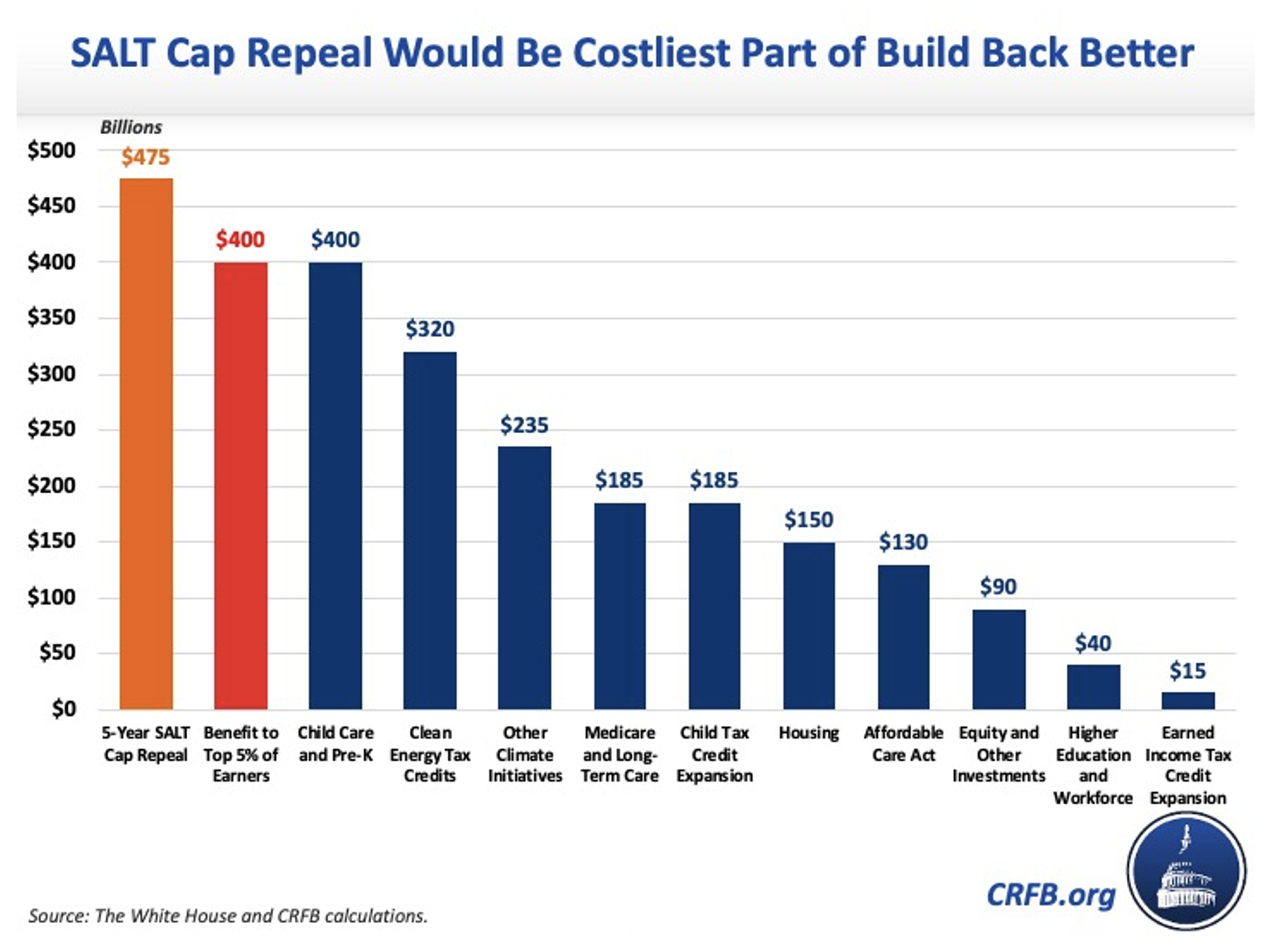

The SALT deduction is a large tax expenditure meaning it is among the provisions in the tax code that provides a special deduction credit exclusion or. The Tax Cuts and. One draft proposal floats 120 billion to lift the cap on state tax deductions for incomes up to about.

52 rows The SALT deduction allows you to deduct your payments for property tax payments and either income or sales tax payments. Democrats are considering including in their social spending package a five-year repeal of the cap on the state and local tax SALT deduction sources told. You can deduct as much sales tax you paid off.

The SALT deduction is one tool for redistributing tax revenue but most working people dont have access to it because they dont itemize their tax deductions to be able to. The TCJA paired back the AMT reducing the number of taxpayers subject to it from about 5 million in 2017 to 200000 in 2018. Lifting the SALT cap.

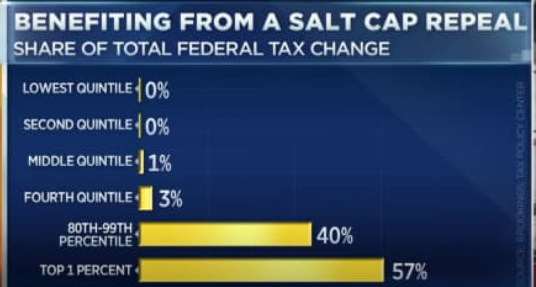

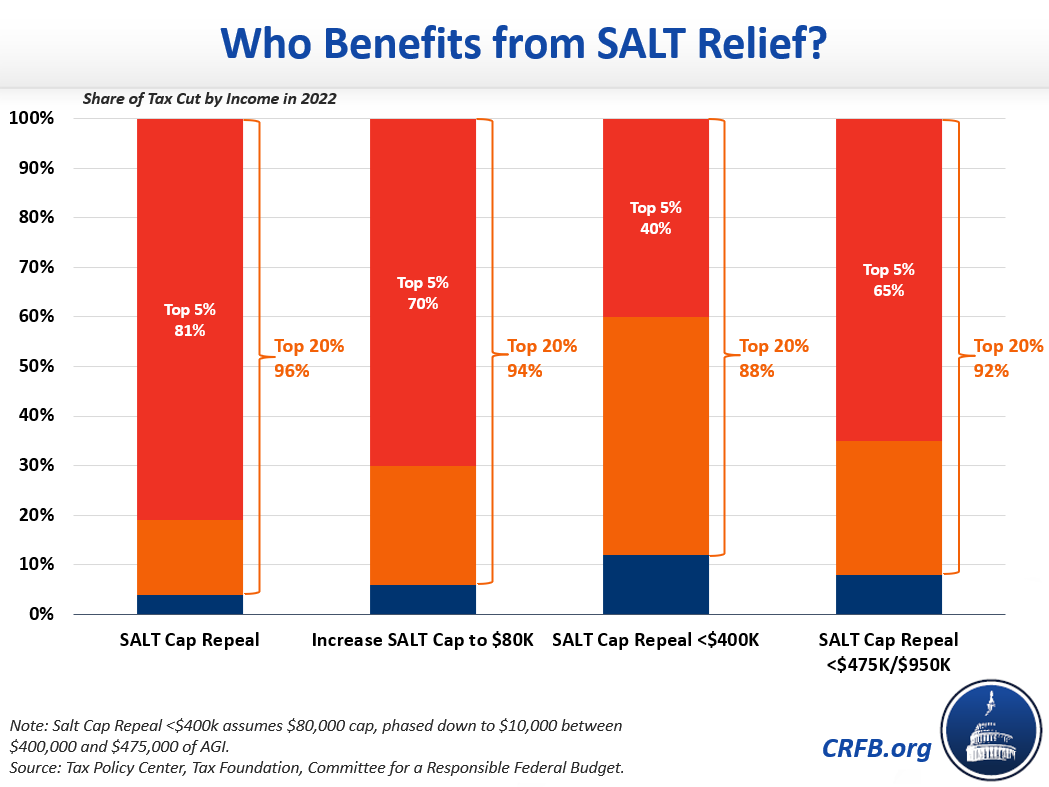

History of the SALT Deduction. The SALT deduction when no cap is in place is a highly regressive tax policy meaning its benefits go to the wealthiest taxpayers who regularly write off over 10000 on. The maximum SALT deduction is 10000.

Full repeal of the SALT cap is the worst option of all Repealing the SALT cap for two years would cost about 85 billion per year. Despite frustration the so-called SALT Caucus failed to remove the 10000 cap on the state and local tax deductions -- popularly known as SALT -- as part of the recent Inflation. The federal tax deduction for state and local tax SALT for taxpayers who itemize deductions was cut from unlimited to 10000 in 2018.

The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. But you must itemize in order to deduct state and local taxes on your federal income tax return. In urging repeal of the 10000 cap on the deduction for state and local taxes SALT Rep.

Democrats consider SALT relief for state and local tax deductions. In 2017 the Republican Tax Cuts and Jobs Act TCJA capped the SALT deduction at 10000 in order to pay for much needed tax relief for working- and middle-class Americans. The House on Thursday passed a bill to temporarily repeal the GOP tax laws cap on the state and local tax SALT deduction advancing a key priority for many Democrats before.

The most you are able to claim the SALT deduction for state and local income taxes paid is 80000 but the sales tax doesnt have a limit. As we and others have pointed out multiple times.

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

Salt Cap Repeal Unlikely Addition To Covid 19 Relief Bill Orange County Register

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

Cuomo Malliotakis And Other Officials Call On Congress To Repeal The State And Local Tax Salt Deduction Cap Silive Com

High Tax State Push To Repeal Salt Cap A Boon To The Rich Fox Business

House Democrats Concede Line In Sand Over Ending Salt Cap Politico

House Likely To Act Soon To Restore Salt Deduction Crain S Chicago Business

Salt Deduction In Jeopardy As Biden Infrastructure Package Moves Ahead

How To Deduct State And Local Taxes Above Salt Cap

Could The State And Local Property Tax Salt Deduction Limit Be Repealed In 2022 Under The New Stimulus Bill Aving To Invest

Why Some Lawmakers Are Pushing To Repeal Salt Caps

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

Dems Hike Taxes On Middle Class To Pay For 475b Salt Tax Shelter For Rich Ways And Means Republicans

Salt Cap Repeal Salt Deduction And Who Benefits From It

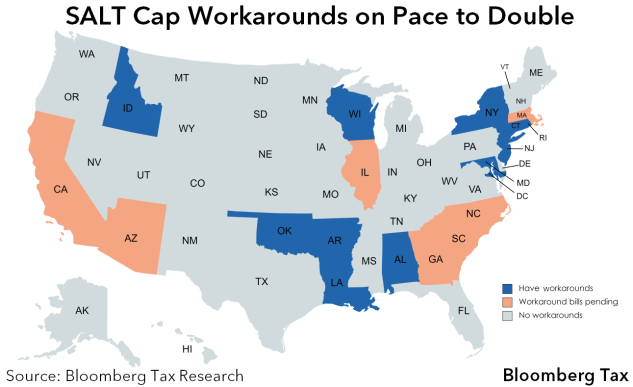

Salt Workarounds Spread To More States As Democrats Seek Repeal

Marc Goldwein On Twitter For Everyone 1 Salt Cap Repeal Pays To Black Households It Pays 13 To White Households Https T Co Vauzg3fley New Iteptweets Study Shows 3 4 Of The Tax Break Goes

Salt Repeal Just Below 1 Million Is Still Costly And Regressive Committee For A Responsible Federal Budget

Dems Don T Repeal The Salt Cap Do This Instead Itep

Democrats Push For Agreement On Tax Deduction That Benefits The Rich The New York Times