when will i get my mn unemployment tax refund

The IRS says it plans to issue another batch of special unemployment benefit exclusion tax refunds before the end of the yearbut some taxpayers will have to wait until 2022. However many people have experienced refund delays due to a number of reasons.

Who Gets Mn Hero Pay And How Unemployment Tax Hike Is Returned

However many people have experienced refund delays due to a number of reasons.

. When will I get my jobless tax refund. Property Tax Refund process. 24 and runs through April 18.

Your 1099-G will give you the information you need to accurately report your unemployment benefits on your state and federal tax returns including. Businesses that received forgivable payroll loans from the federal government and Minnesotans who got extra jobless benefits last year will begin seeing state tax refunds in the next few weeks. Many people had already filed their tax returns by.

Additional Assessment for 2022 from 1400 to 000. 21 days or more since you e-filed. If you did not receive a letter then they will adjust the return and notify you when they are done.

The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. If youre due a refund from your tax year 2020 return you should wait to get it before filing Form 1040X to amend your original tax return. FOX 9 - Minnesota will take weeks or months to refund taxes paid on unemployment benefits and COVID-19 pandemic-related business loans.

Here is the link to this article. Start wNo Money Down 100 Back Guarantee. I need to get the information on my 2021 income tax from unemployment so I can file my taxes Im having a hard time getting a hold of the people to get it done Ive moved so the.

The new law reduces the amount of unemployment tax and assessments a taxpaying employer will owe in 2022. During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes. The IRS normally releases tax refunds about 21 days after you file the returns.

The IRS is now concentrating on more complex returns continuing this process into 2022. Federal and MN State unemployment tax refund. In the latest batch of refunds announced in November however the average was 1189.

- The Minnesota Department of Revenue announced today that the processing of returns impacted by tax law changes made to the treatment of Unemployment Insurance compensation and Paycheck Protection Program loan forgiveness will begin the week of September 13. Individual Income Tax process. You can If you received unemployment in 2020 and filed BEFORE Minnesota changed their law of taxing the unemployment income you may be getting a letter informing you that you will be receiving an.

So it looks like you have done everything on your end and at this point you can wait to receive your refunds or further instructions. 1222 PM on Nov 12 2021 CST. The agency had sent more than 117 million refunds worth 144 billion as of Nov.

When will I get the refund. I filed my taxes for 2020 before Congress passed the new act stating 10200 of unemployment would be non-taxable. 3rd Quarter July 1 - September 30 October 31.

The law that made up to 10200 of jobless income exempt from tax took effect in Mar. The new law reduces the. Base Tax Rate for 2022 from 050 to 010.

Every return we receive is different so processing time will vary. 4th Quarter October 1 - December 31 January 31. The IRS has identified 16 million people to date who may qualify for an associated tax refund or other benefit.

Quarterly wage detail reports and payments must be received by the department on or before the due date. Ad Honest Fast Help - A BBB Rated. How is Income Tax Paid on Unemployment.

On March 31 2021 the IRS announced the. Due dates are the last day of the month following the end of the calendar quarter. Date of Release.

The Minnesota Legislature has passed and Governor Walz has signed into law a Trust Fund Replenishment bill. This notice is not confirmation that you are eligible. When ready you will see the date your refund was sent.

I received my refund original in March. The system shows where in the process your refund is. If you received an unemployment benefit payment at any point in 2021 we will provide you a tax document called the 1099-G.

Because we made changes to your 2020 tax account to exclude up to 10200 of unemployment compensation you may be eligible for the Earned Income Credit. The IRS plans to issue another batch of. The total amount of unemployment benefits you were paid.

2nd Quarter April 1 - June 30 July 31. The IRS normally releases tax refunds about 21 days after you file the returns. The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time.

Everything you need to know about the re-reboot of your favourite childhood flick. COVID Tax Tip 2021-87 June 17 2021 The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable amount of unemployment compensation and tax. The links below will take you step-by-step through the return process.

FOX 9 - Many Minnesota tax filers will get an automatic refund within weeks because of tax breaks passed overnight by lawmakers state Revenue Department officials said. How Do I Reset My Unemployment Username And Password. In December 2021 the IRS sent the CP09 notice to individuals who did not claim the credit on their return but may now be eligible for it.

On September 13th the State of Minnesota started processing refunds to those that had paid income tax on the first 10200 on their unemployment income. Some taxpayers will receive refunds while others will have the overpayment applied to taxes due or other debts. The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year.

2 days agoMinnesota Gov. Download the IRS2Go app to check your refund status. For eligible taxpayers this could result in a refund a reduced balance due or no change to tax.

About 500000 Minnesotans are in line to.

When Will Irs Send Unemployment Tax Refunds 11alive Com

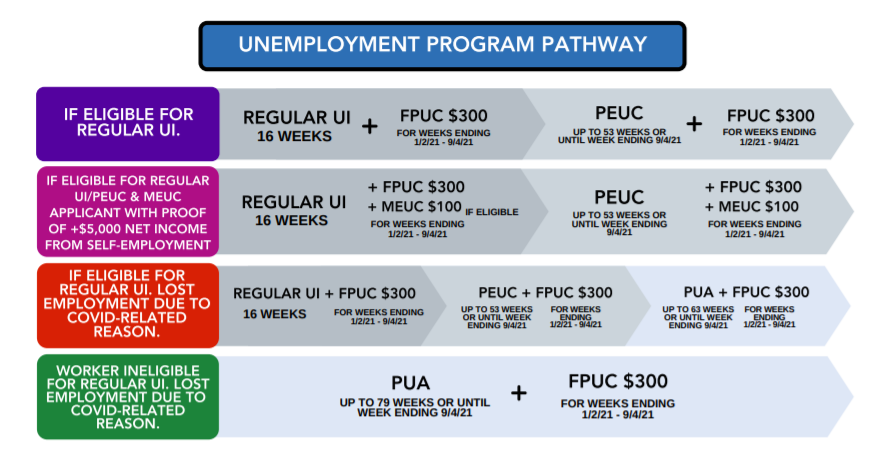

Minnesota Mi Deed Unemployment Benefit Extensions To 300 Fpuc Pua And Peuc Programs Has Ended Retroactive Payment Updates Aving To Invest

I Owe Minnesota Unemployment Compensation For An Overpayment Can Bankruptcy Help Walker Walker Law Offices Pllc

Where S My Refund Minnesota H R Block

Unemployment Tax Refund Update What Is Irs Treas 310 Kare11 Com

Ppp Ui Tax Refunds Start In Minnesota

Unemployment Compensation Are Unemployment Benefits Taxable Marca

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Mn Dept Of Revenue Begins Processing Unemployment Insurance Compensation Ppp Loan Forgiveness Wcco Cbs Minnesota

Mn Legislature Yet To Reach Deal On Unemployment Insurance Bring Me The News

House Oks Unemployment Insurance Bill Kare11 Com

House Oks Unemployment Insurance Bill Kare11 Com

Unemployment Tax Break Surprise 581 Checks Paid Out To 524 000 Americans In Time For New Year S Eve Marca

Irs Will Automatically Refund Taxes Paid On Some 2020 Unemployment Benefits Ds B

Mn Department Of Revenue Will Begin Sending Tax Refunds For Ppp Loans And Extra Jobless Aid In Next Few Weeks Wcco Cbs Minnesota